Hand Over Your Account, I Trade & Profit for You!

MAM | PAMM | LAMM | POA

Forex prop firm | Asset management company | Personal large funds.

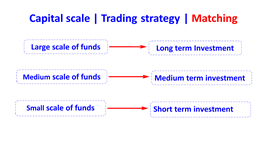

Formal starting from $500,000, test starting from $50,000.

Profits are shared by half (50%), and losses are shared by a quarter (25%).

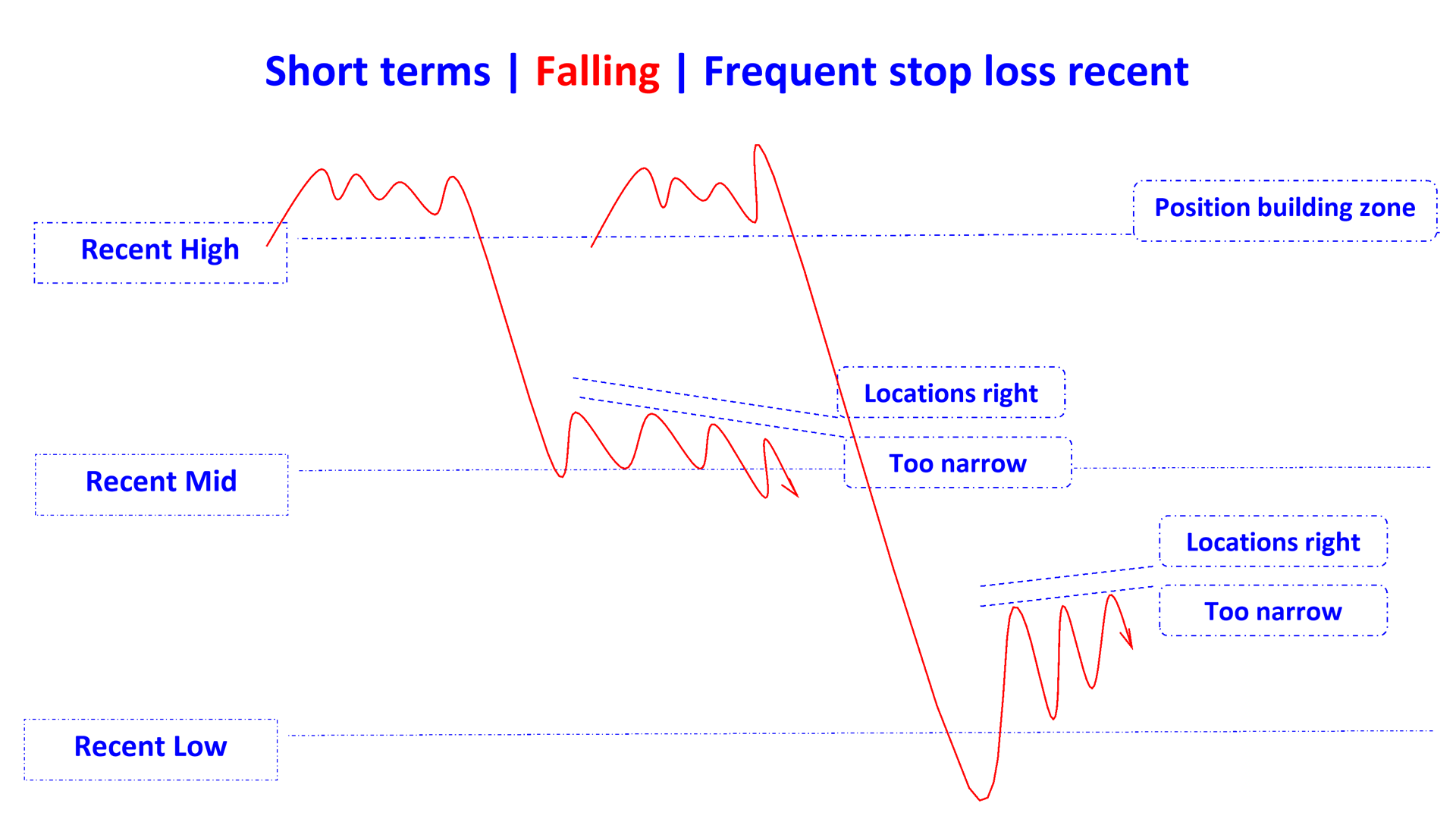

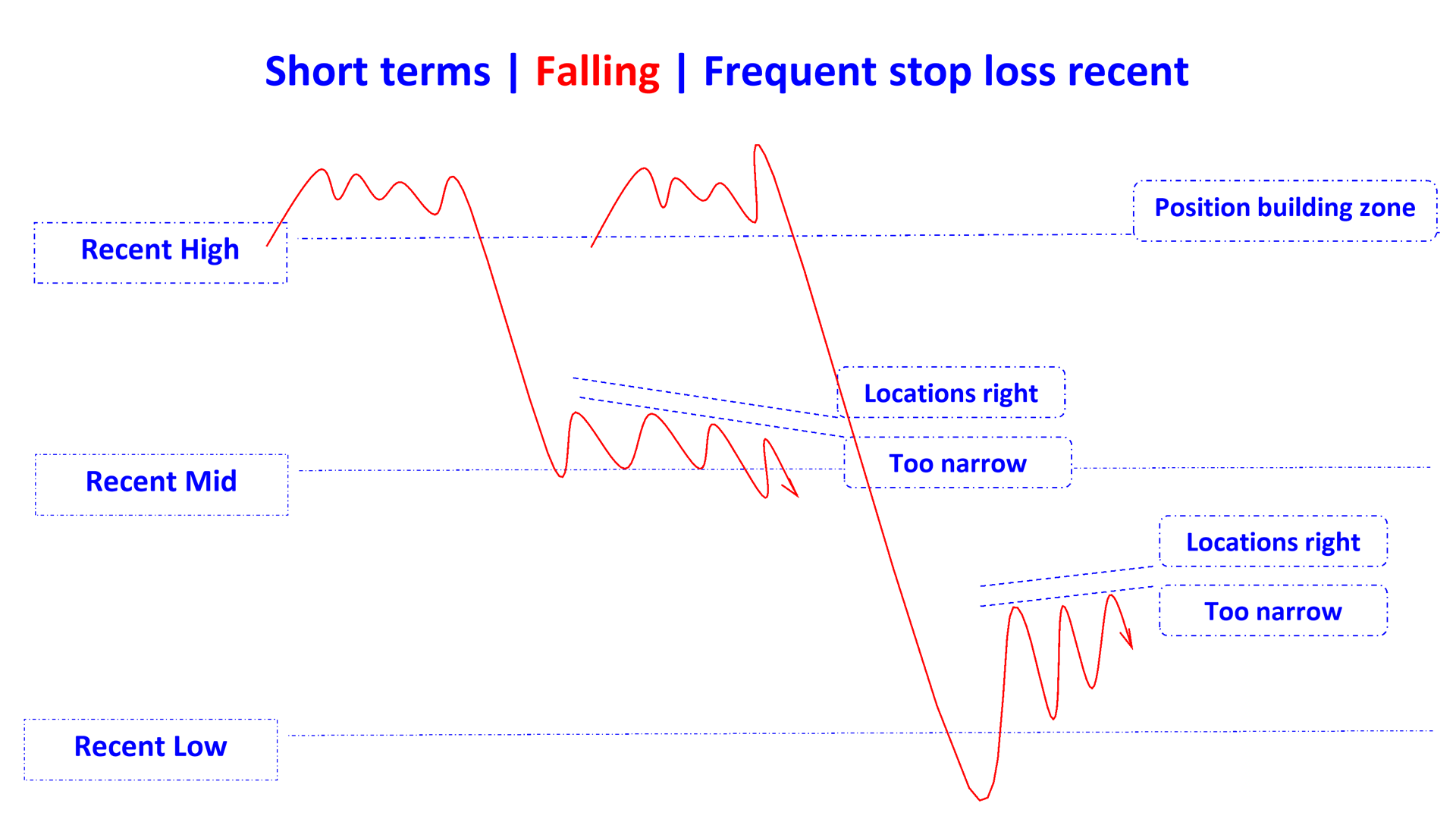

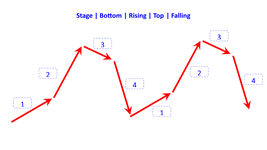

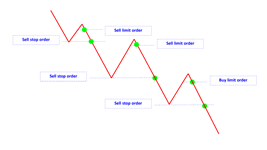

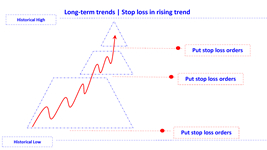

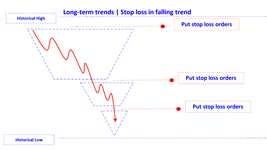

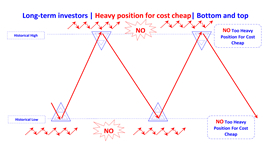

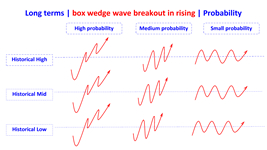

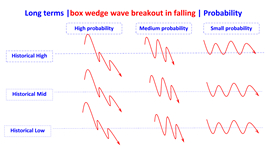

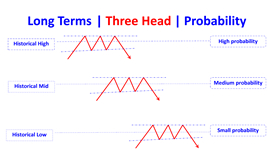

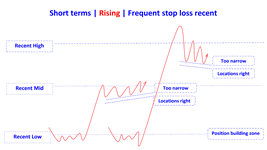

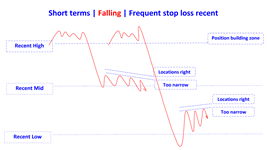

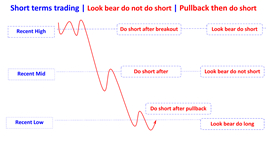

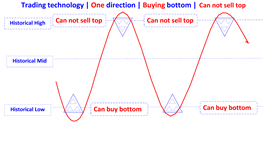

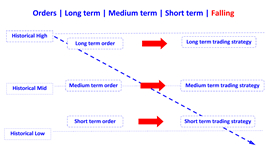

Foreign exchange manager strategy:Short terms | Falling | Frequent stop loss recent

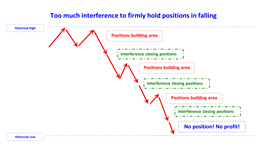

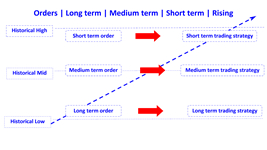

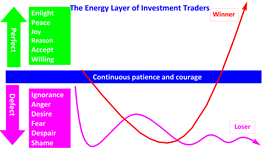

In foreign exchange investment transactions, the reason why short-term success is difficult is that it is difficult to grasp the short-term direction, coupled with frequent stop-losses, not only wasting costs, but also frustrating confidence, making it impossible to enter the market again, or even exiting the trading completely. In a short-term downward trend, no matter whether the trend distance is shortened or lengthened, it is reasonable to enter the market after a retracement and the stop loss line is slightly farther from the resistance zone.

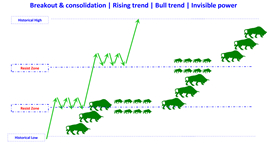

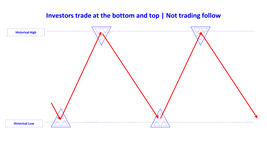

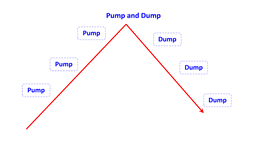

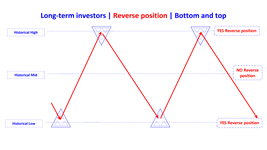

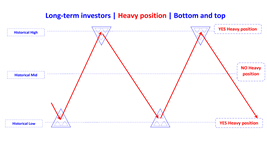

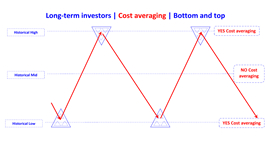

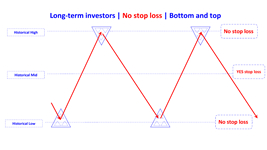

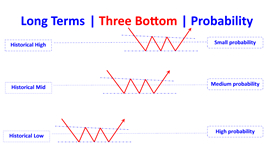

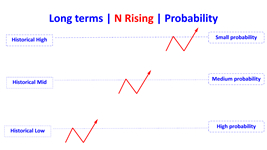

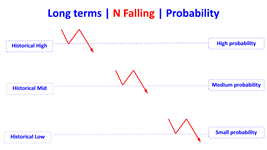

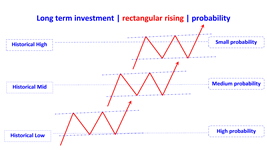

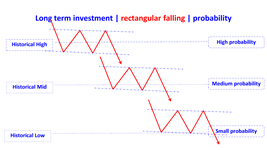

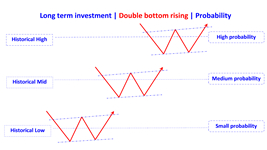

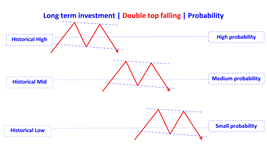

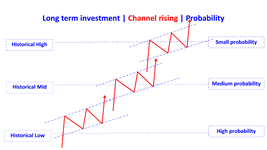

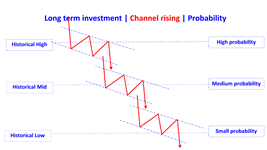

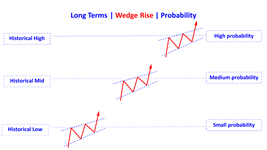

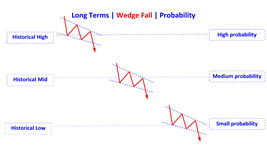

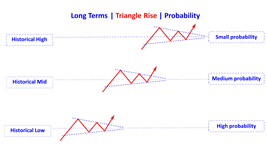

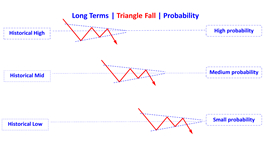

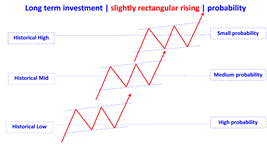

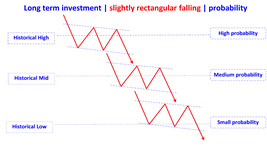

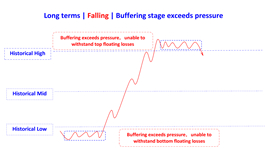

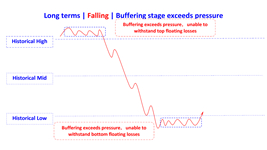

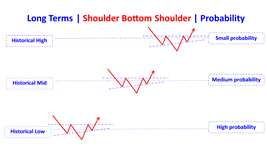

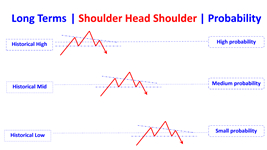

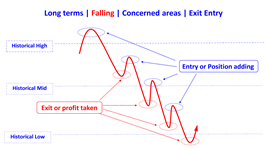

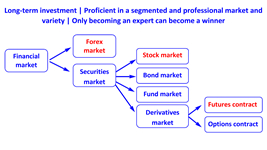

Strategy animation demonstration

Strategy picture display

13711580480@139.com

13711580480@139.com

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

z.x.n@139.com

z.x.n@139.com

Mr. Z-X-N

Mr. Z-X-N

China · Guangzhou

China · Guangzhou

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

Mr. Z-X-N

Mr. Z-X-N

China · Guangzhou

China · Guangzhou